Colombo, June 1 (News1st) – Sri Lanka’s Finance Ministry has decided to impose a 100% surcharge rate on both General and Preferential Custom Duty of multiple products with effect from Wednesday (1).

A surcharge — or additional charge — is essentially a tax levied on a tax. It is calculated on payable tax, not on income generated.

For similar articles, join our Telegram channel for the latest updates. – click here

These measures come after Sri Lanka decided to relax import restrictions that it imposed on 369 items with effect from the 1st of June 2022.

Accordingly, a total of 369 HS Codes, which were regulated can be imported without an Import Control License effective from June 01, 2022 subject to applicable rules and regulations including duties and taxes at the time of Customs clearance of cargos/consignments.

The Finance Ministry has also decided to permit open account imports until June 07th, 2022.

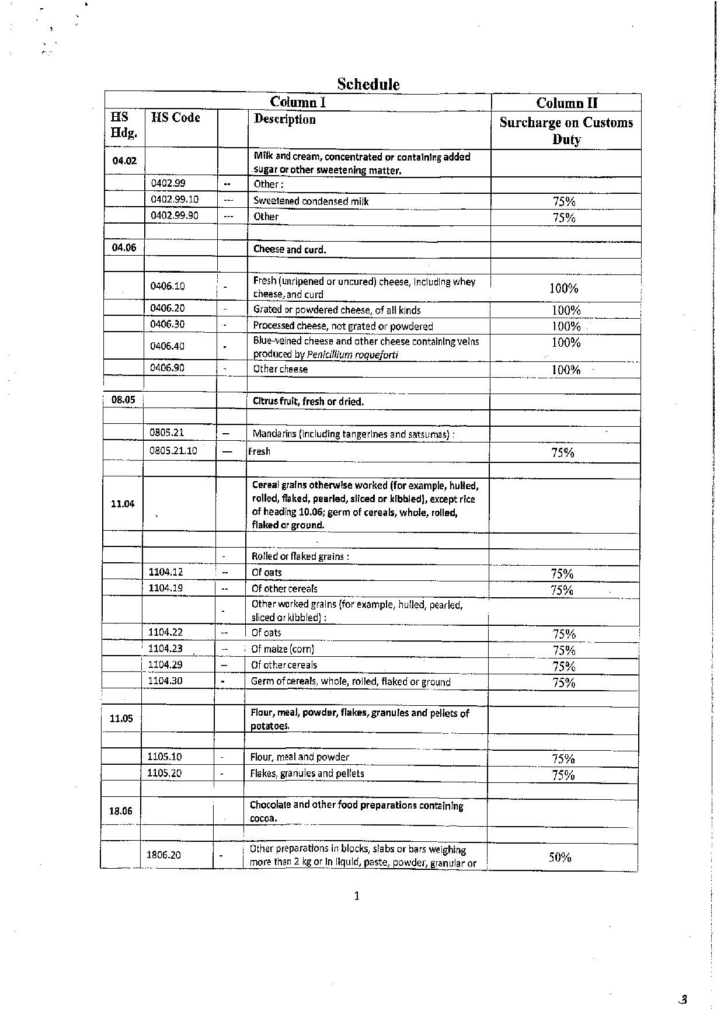

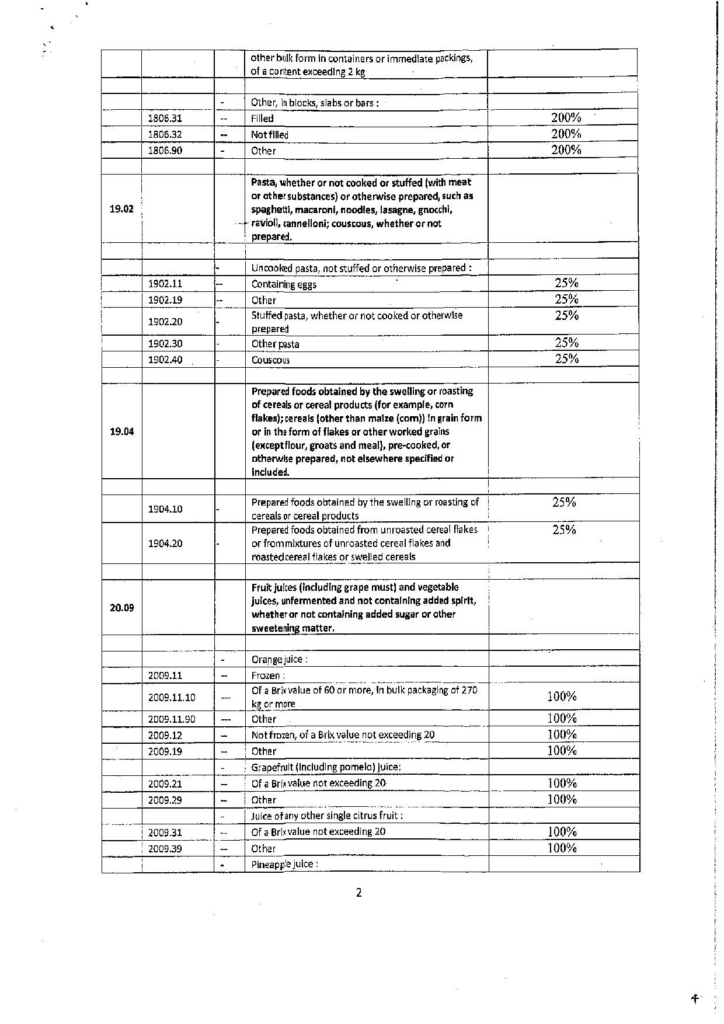

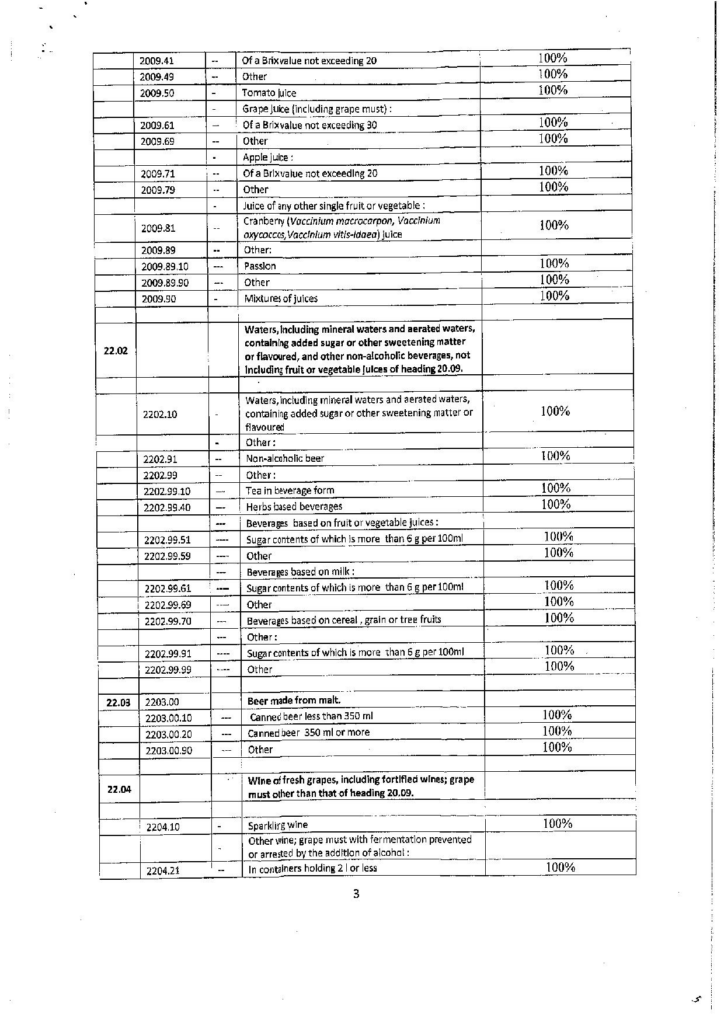

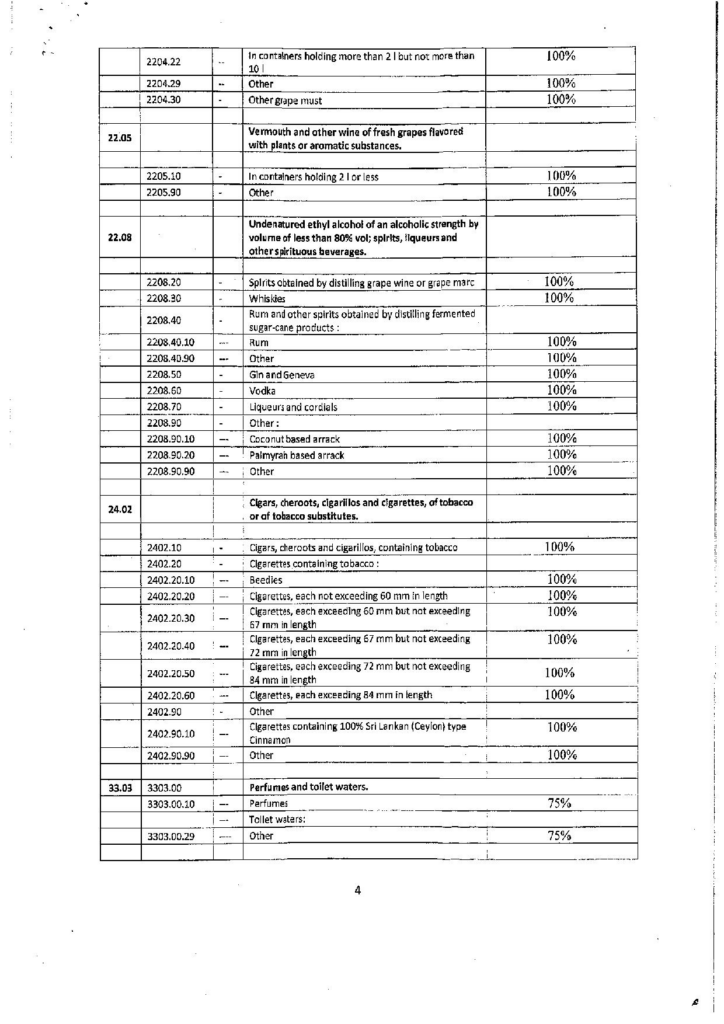

Here’s how the new Surcharge works:

The Finance Ministry imposed a 200% surcharge on Chocolate and other food preparations containing cocoa.

Meanwhile, the surcharge imposed on imported Cheese is 100%, which means the Rs. 1000/- tax on a kilogram of imported cheese is now Rs. 2000/-.

The import tax on Apples and Grapes will increase from Rs. 300/- per kilogram to Rs. 600/- per kilogram.

Incidentally, the import tax on Oranges will seek a spike from Rs. 200/- per kilogram to Rs. 600/- per kilogram.

Moreover, the surcharge tax on Cigars, Cheroots, and Cigarettes of Tobacco or of Tobacco substitutes, as well as Liquor and Spirits is 100% in addition to the import tax.

Subscribe to our Telegram channel for the latest updates from around the world

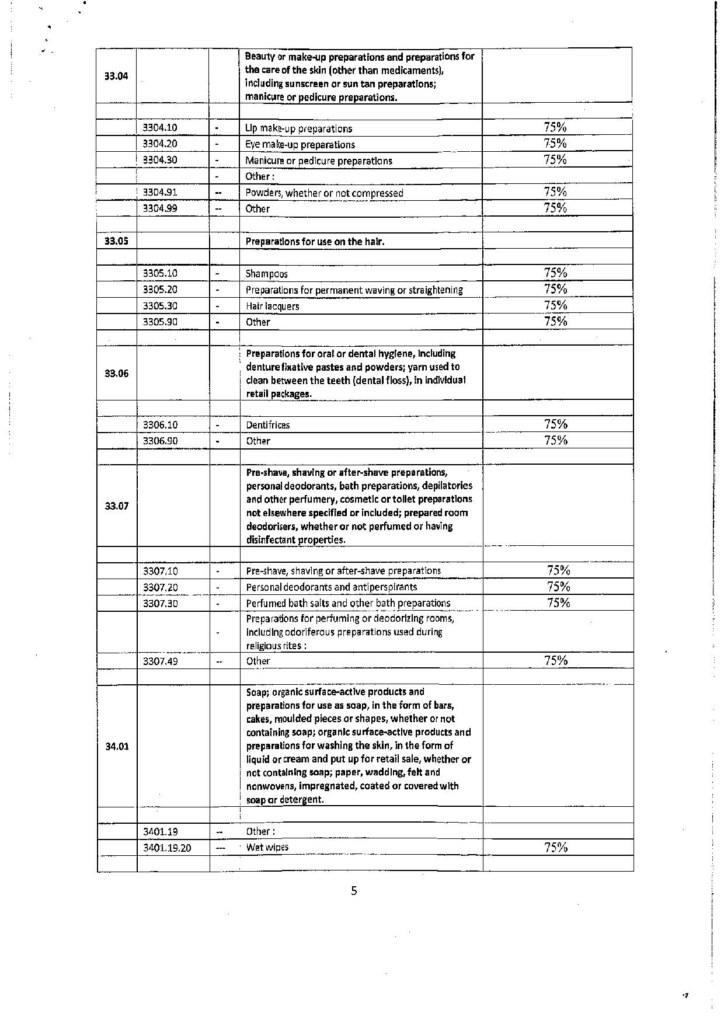

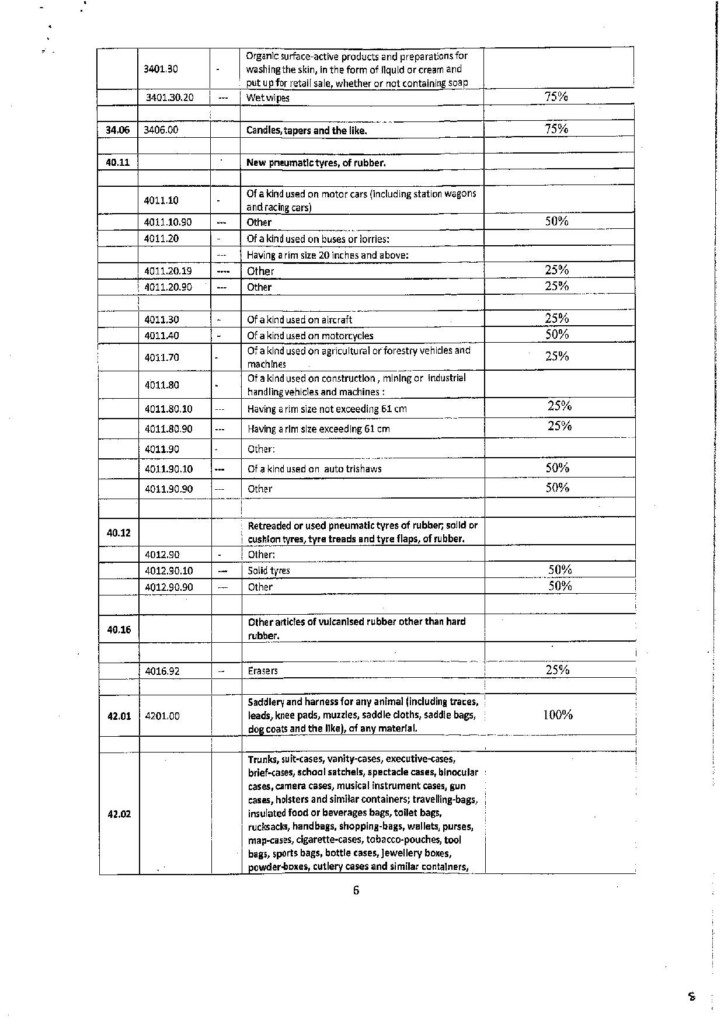

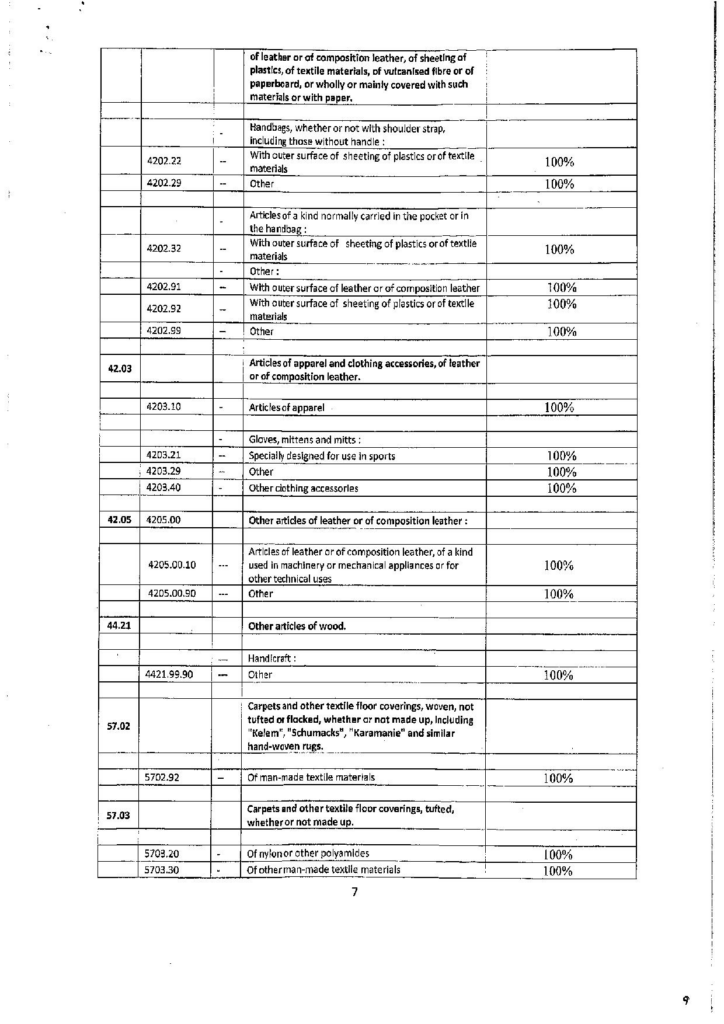

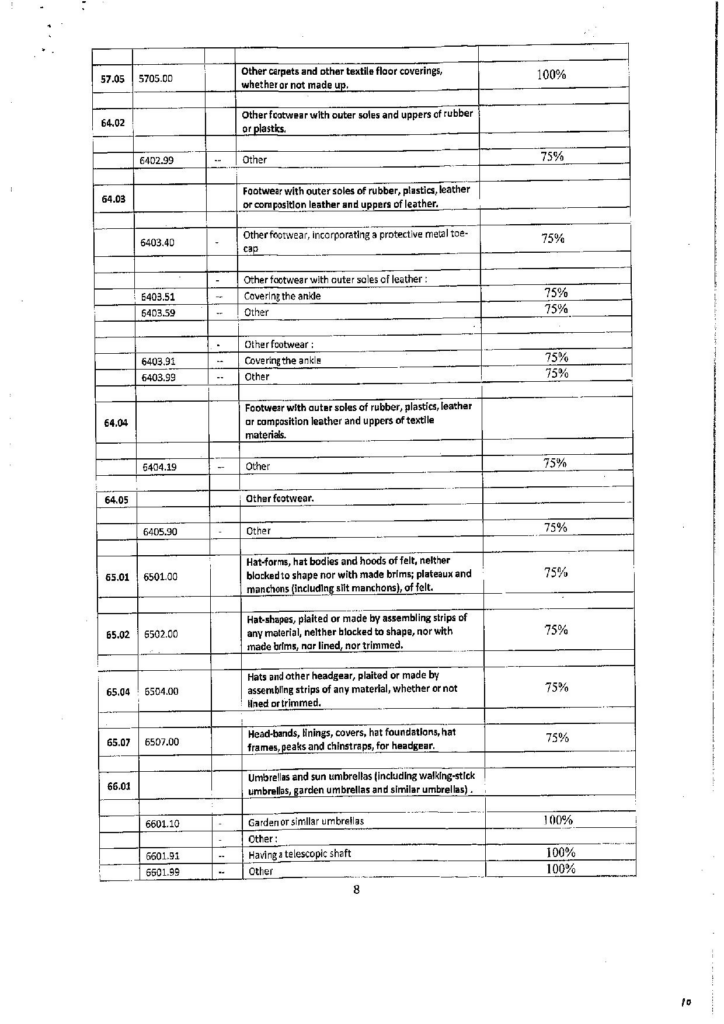

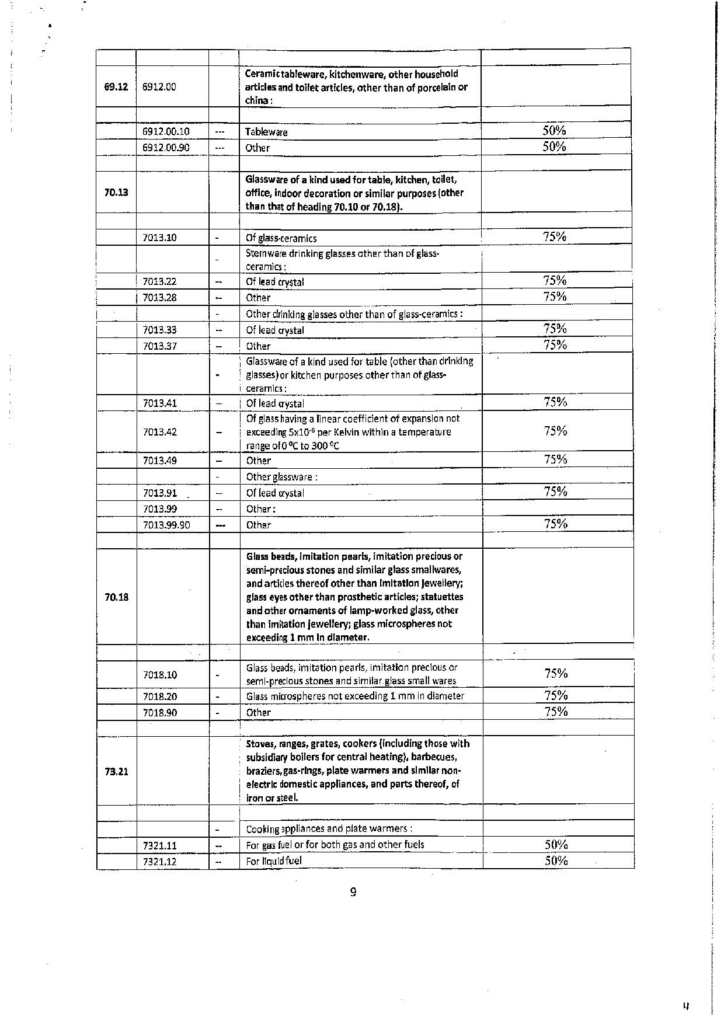

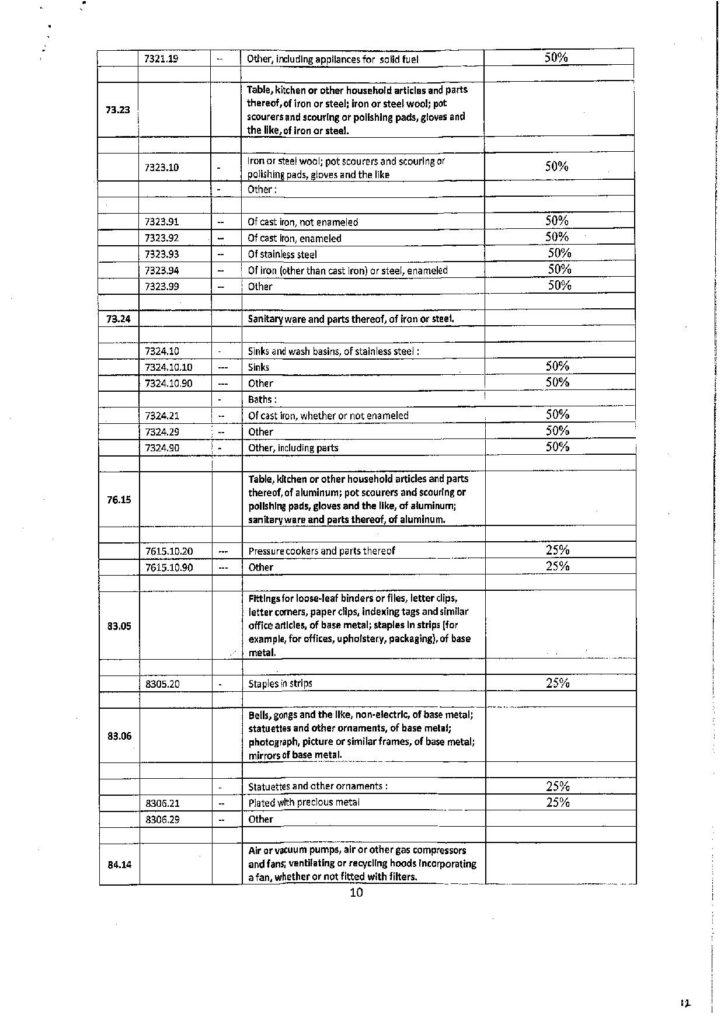

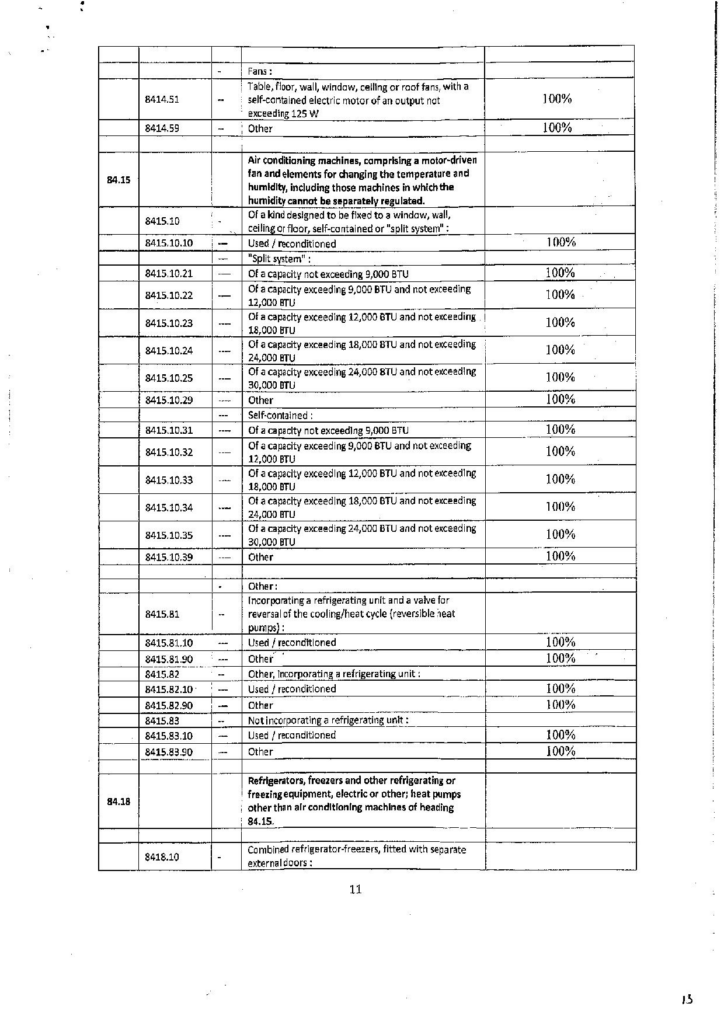

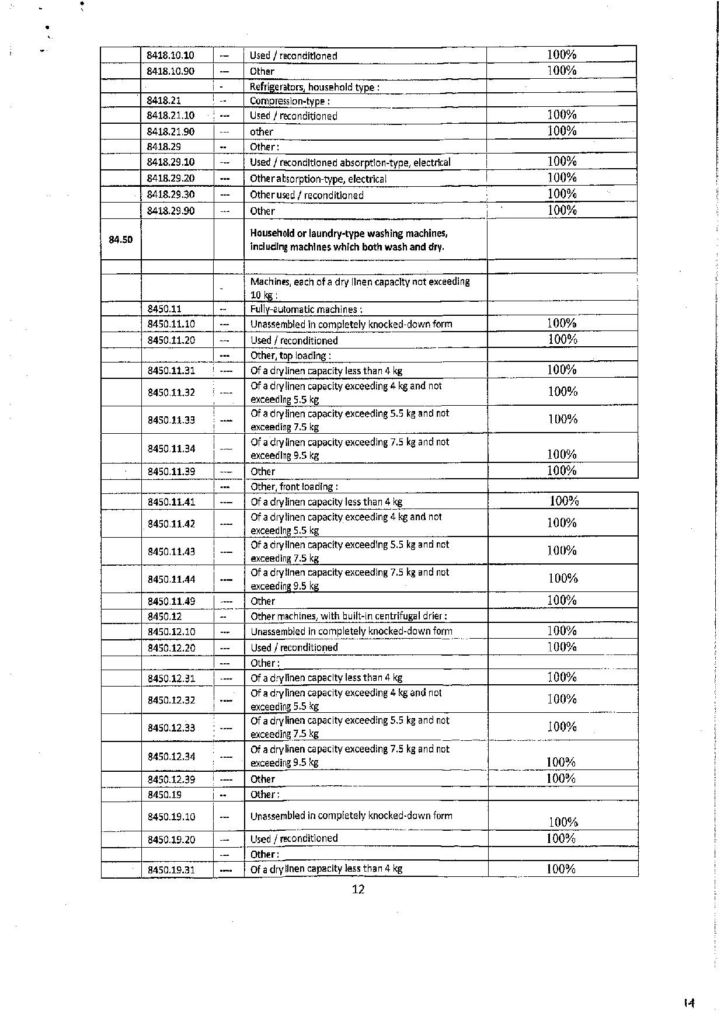

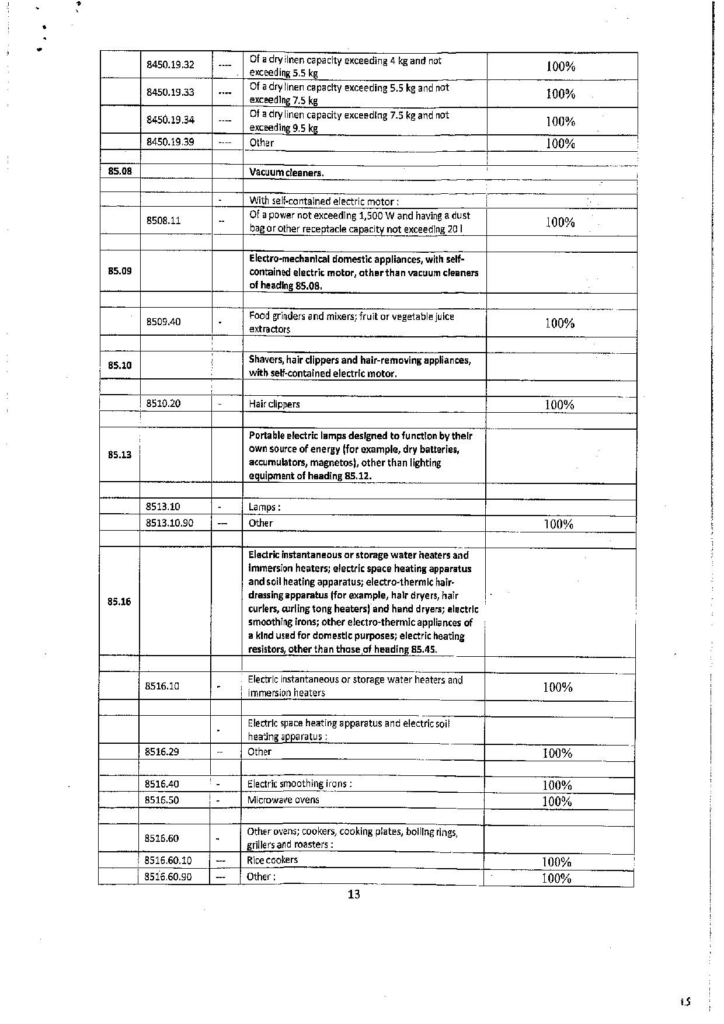

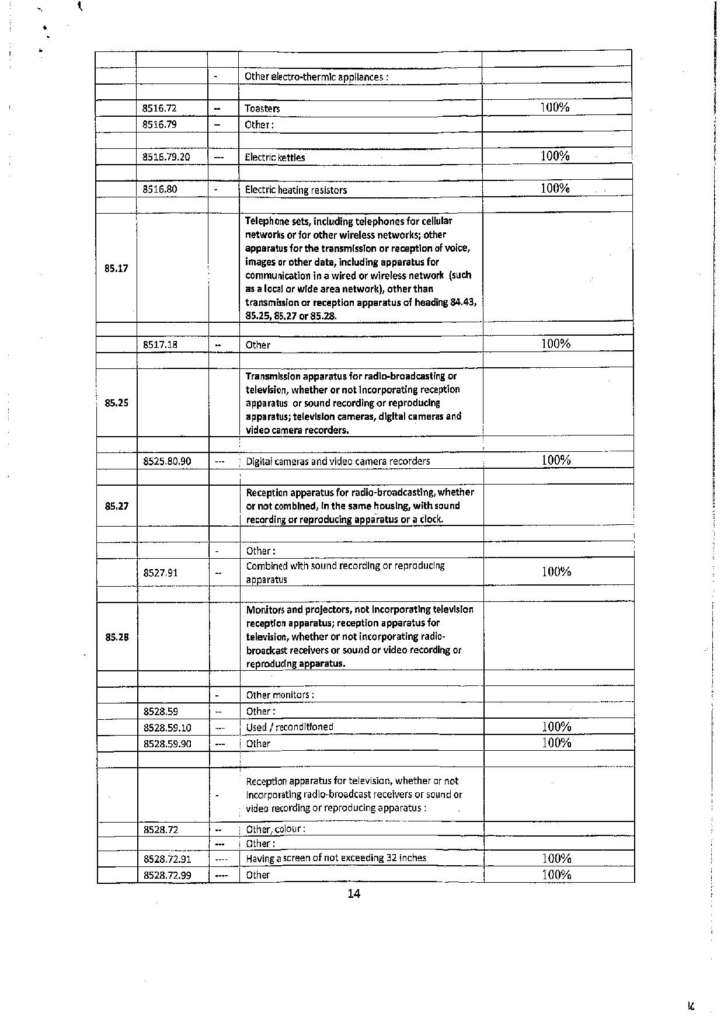

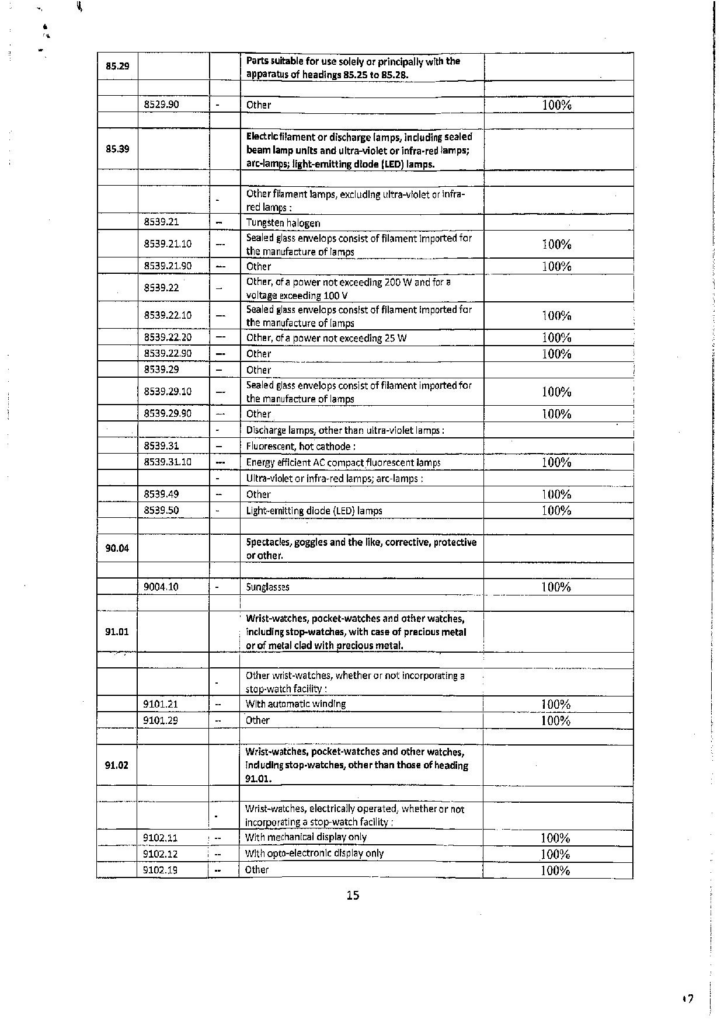

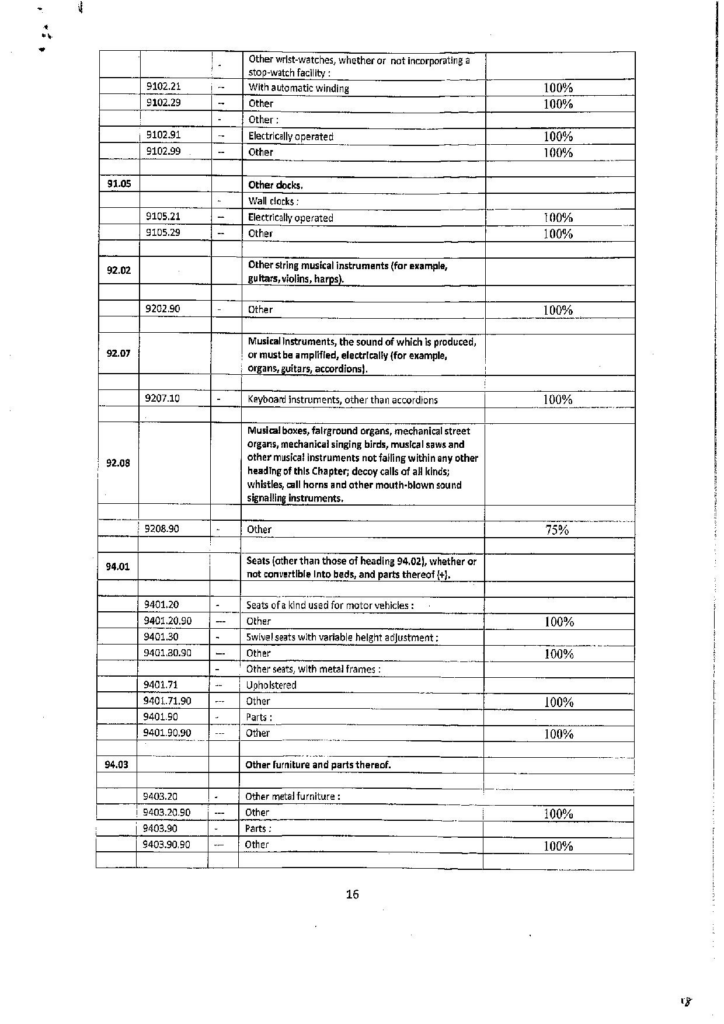

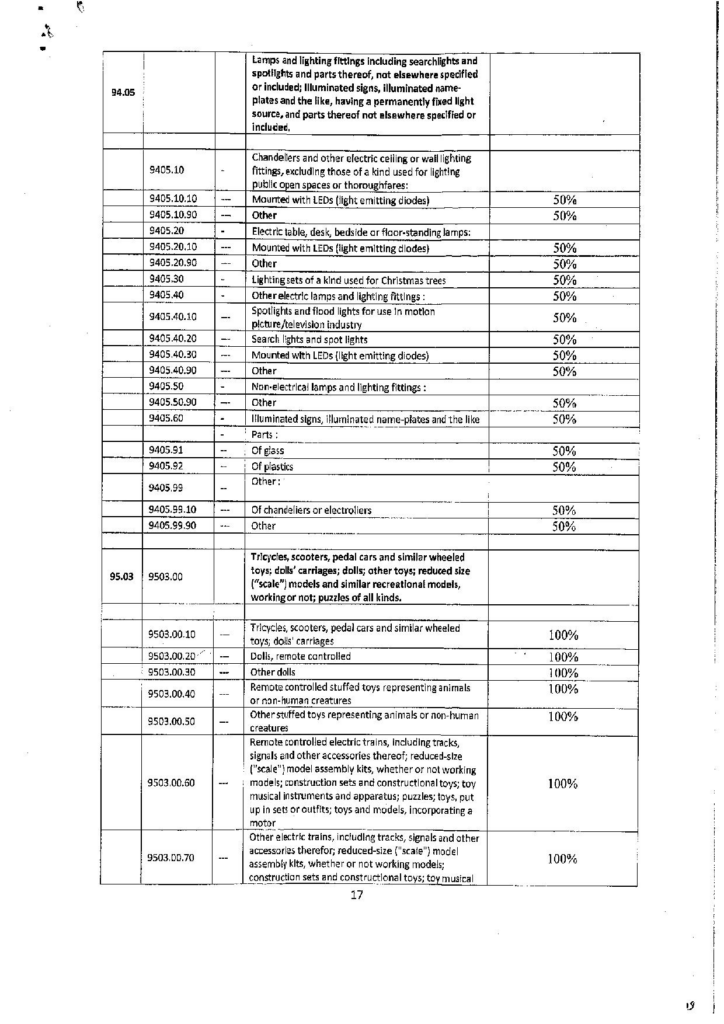

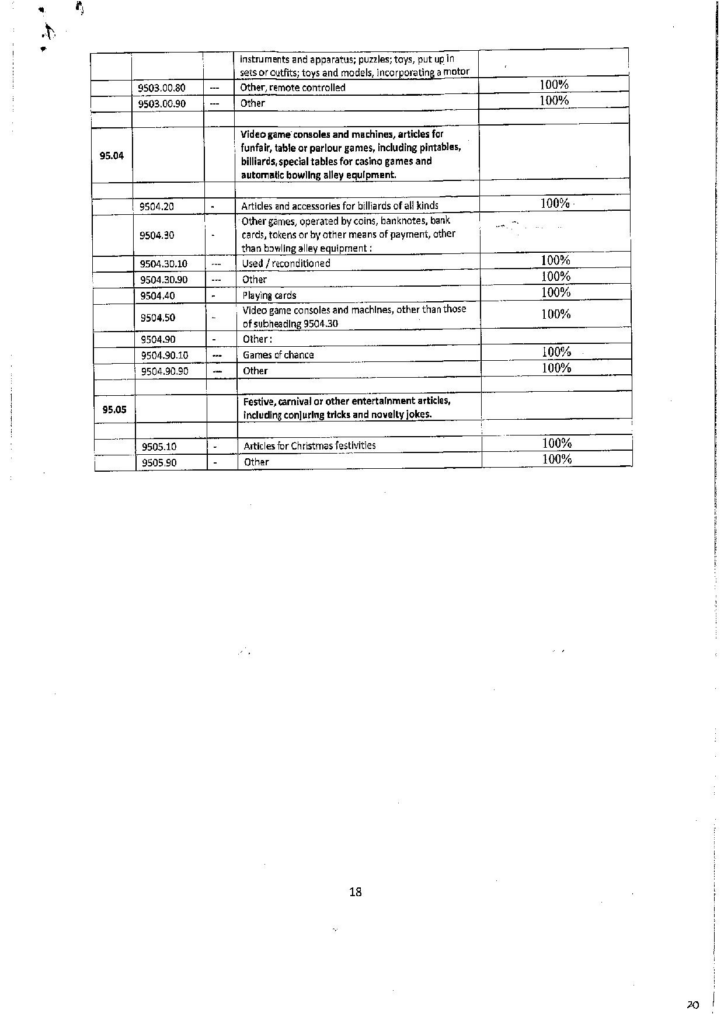

Full list of products as released by the Finance Ministry: